The Ultimate Guide To Loss Adjuster

Table of ContentsSome Ideas on Loss Adjuster You Need To KnowMore About Loss AdjusterSome Known Details About Property Damage Top Guidelines Of Loss AdjusterThe Best Guide To Public AdjusterThe 10-Minute Rule for Loss Adjuster

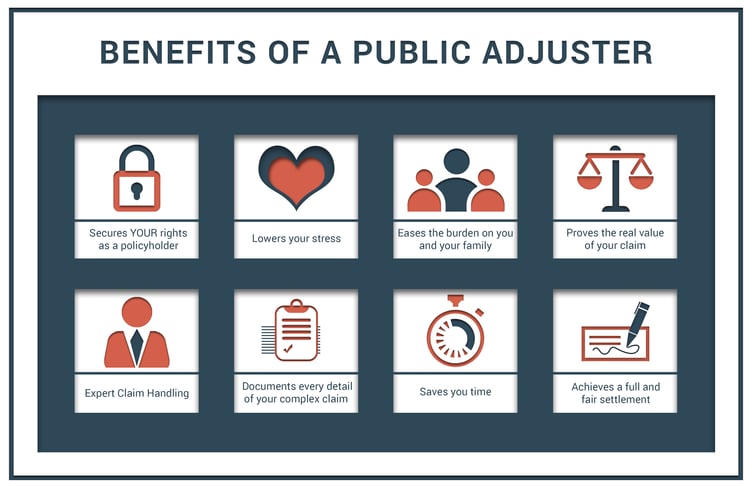

If you wish to ensure that you get all the benefits supplied by your insurance plan as well as the largest settlement possible, it's worth getting in touch with a public insurance coverage insurer today! They are experts that work to get you the very best negotiation feasible from your insurance firm. They can assist identify what is as well as isn't covered by your plan, as well as they will manage any kind of disputes or settlements in your place.There are one-of-a-kind kinds of insurance coverage case adjusters: The insurance policy holders themselves as well as not the insurer work with public insurers. Outside adjuster contracted by the insurance policy company. Generally from huge firms who consent to the insurance provider's pre-set protocols. Personnel insurance adjusters are worked with by the insurer. They are either outside professionals or much more usually function within the business itself (loss adjuster).

Out of all the courses of insurance policy case adjusters, public insurance adjusters are the only ones that are independent of insurance policy companies. They are employed by the policyholder to go over the claim as well as to make sure that they receive the proper amount of cash. The objective is to get the insurer to cover the entire damage or loss to their buildings or home from a catastrophe or accident.

Everything about Loss Adjuster

They were put right into location to ensure that insurance coverage business would certainly pay all cases from customers as well as not try to lower costs by underpaying for a case or denying it entirely. The public insurer's task is easy: they examine your policy, establish what you are owed, and after that deal with in your place to obtain the full negotiation.

If you have a mortgage, the lien holder also will be a payee, as will certainly any kind of various other celebrations with insurable interests. A public insurance adjuster acts as your representative to the insurer. Their purpose is to browse all stages of the claim procedure as well as advocate for the very best interests of the insured.

Not known Incorrect Statements About Property Damage

This permits the insured to focus on other, more vital tasks instead of handling the anxiety of insurance negotiations. This is especially practical in the days and weeks adhering to a loss. There are many different obligations that public adjusters carry out for the insurance policy holder: Determine Insurance coverage: Examine and also examine the insurance coverage and also determine what coverage and limitations use.

Some insurance coverage adjusters have much more experience and will certainly do a better job. Not all insurance coverage asserts comply Recommended Site with a set path.

Unknown Facts About Public Adjuster

That the negotiation amount will totally bring back the insurance holder's building to pre-loss problem. Any kind of suggestion that confirming these points is very easy, or that a computer system can do it for you, just isn't true. Cases really rapidly end up being a twisted mess because the: Loss conditions are not plainly mentioned, not appropriately examined and recorded, or they include multiple causes or numerous policies.

The negotiating procedure starts as quickly as you incur a loss. In case of a loss, it is very important to be prepared and also have all your documents at hand. If the loss is substantial, you might want to get to out to a public insurance coverage adjuster initially. But you ought to inform your insurer asap.

Know that they will be examining just how much you know concerning your policy limits, the damages you have received and also if you are looking to an agent, public adjuster or insurance policy provider for guidance. A public adjuster breaks the assessment cycle, stepping in as your special professional rep. With an equal opportunity, great deals of documents, as well as iron-clad evidence check of all assessments, it is challenging for the insurer to say for anything less than a full and also reasonable negotiation.

The Ultimate Guide To Public Adjuster

All we can do is share what we have actually won for customers. The chart below shows several of the a lot more moderate claims that we've aided to settle. As you can see in every instance we gained our customers at least double the amount of the initial insurer deal. This Chart of Recent Healings reveals simply a few of the negotiations that we have actually helped to win.

Keep in mind that there is a great deal at stake, and the insurance policy business has great deals of experience in managing results. When disagreements arise, your public adjuster will know what to do as well as function to fix the issue successfully.

The bargaining procedure begins as soon as you sustain a loss. In case of a loss, it is essential to be prepared and have all your documentation available. If the loss is substantial, you may want to get to out to a public insurance coverage insurer. You need to inform your insurance business as soon as possible.

Not known Facts About Public Adjuster

All we can do is share what we have won for clients. The chart below shows several of the extra moderate insurance claims that we've helped to work out. As you can see in every instance we gained our clients a minimum of dual the quantity of the original insurer deal. This Graph of Current Recuperations reveals just a few of the settlements More about the author that we've aided to win.

Bear in mind that there is a lot at risk, and also the insurance coverage company has great deals of experience in controlling outcomes. When disputes develop, your public insurer will certainly know what to do as well as function to resolve the issue successfully.